Current Ratio Benchmark by Industry

Inventory Turnover Ratio Benchmark Example. This is a much more conservative measure of liquidity.

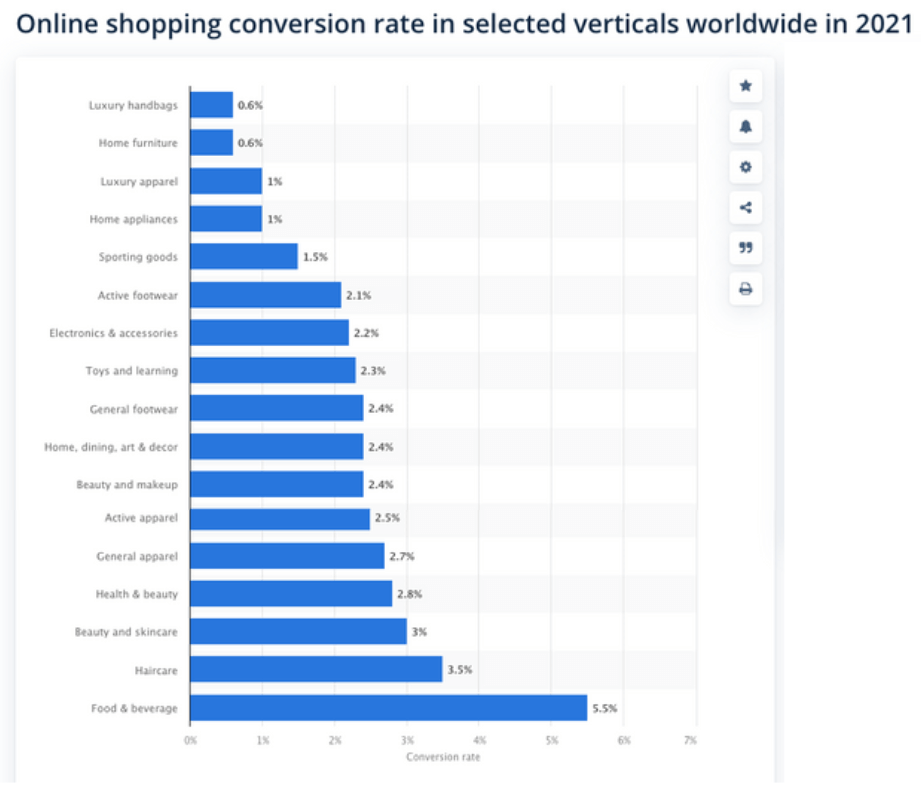

E Commerce Conversion Rates Benchmarks 2022 How Do Yours Compare

Both are based on balance sheet items.

. A decent way to compare a firms trade credit management is to compare its ratios with the industry averages. An Inventory Turnover Ratio that strikes the best balance between inventory efficiency and sales maximization will vary by industry segment. Good explanation of CA.

Interpretation and benchmark Current ratio Current assets Current liabilities Short-term debt paying ability. The two most common liquidity ratios are the current ratio and the quick ratio. In this scenario an investor would use the Russell 3000 Index as a benchmark for equity and the Bloomberg Agg as a benchmark for fixed income.

Its especially helpful for the businesses lenders that assessability of the business to repay their dues. Current assets less current liabilities working capital the relatively liquid portion of an enterprise that serves as a safeguard for meeting unexpected obligations arising within the ordinary operating cycle of the business. However the most commonly used variable is the earnings of a company from the last 12 months or one year.

It depends on the industry practices. Liquidity ratios measure your companys ability to cover its expenses. Where is the benchmark return and is the covariance matrix of assets in an index.

Like our bodys temperature has a benchmark of 96 to 98 degrees Celsius and that is true for all human beings there is no such benchmark for this ratio. Grocery stores can turn over their inventory nearly twice as fast. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

PG HA ROT 2 Quick acid-test. CSI Market estimates the retail industry turns its inventory around 75 times per quarter. Current ratio current assetscurrent liabilities.

PE Ratio by Sector US Data Used. While creating an index fund could involve holding all investable assets in the index it is sometimes better practice to only invest in a subset of the assets. For instance with the debt-to-equity ratio arguably the most prominent financial leverage equation you want your ratio to be below 10.

This ratio is a rough indication of a firms ability to service its current obligations. Quote rachel 28 November 2013. Generally the higher the current ratio the greater the cushion between current obligations and a firms ability to pay them.

So generally the higher. The current ratio is a reflection of financial strength. Price-Earnings Ratio - PE Ratio.

While a stronger ratio shows that the numbers for current assets exceed those for current liabilities the composition and. Retail is an industry that is expected to generate cash on a day-to-day basis and its easy for lenders to get. Analysts and investors can consider earnings from different periods for the calculation of this ratio.

Quote Guest 7 May 2015. Quote Oluwaseun 3 March 2015. PE Ratio or Price to Earnings Ratio is the ratio of the current price of a companys share in relation to its earnings per share EPS.

The current ratio is an essential financial matric that helps to understand the liquidity structure of the business. Average values for the ratio you can find in our industry benchmarking reference book Current ratio. A ratio of 01 indicates that a business has virtually no debt relative to equity and a ratio of 10 means a companys debt and equity are equal.

In most cases a particularly sound one will fall. On which companies are included in each industry Industry Name. It is the number of times a companys current assets exceed its current liabilities.

The quick ratio or acid test ratio is similar to current ratio except it excludes inventory which can be slow moving. They may also want to use the Sharpe Ratio to ensure. These considerations lead to the following mixed-integer quadratic programming MIQP problem.

Aggregate Mkt Cap Net Income all firms Aggregate Mkt Cap Trailing Net Income only money making firms Expected growth in EPS - next 5 years. The Average Current Ratio for Retail Industry. Ratios of a firm having vicinity to the.

A ratio of 11 means you have no working capital left after paying bills. IT IS WELL EXPLANATORY.

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

Current Ratio Explained With Formula And Examples

B2b Sales Benchmark Research Finds Some Pipeline Surprises Salesforce

No comments for "Current Ratio Benchmark by Industry"

Post a Comment